The small island nation of Bahrain announced on April 1, that it had discovered extensive tight oil and deep gas resources off the west coast of the kingdom, which could make the once marginal oil producer potentially a major player in the market.

Bahrain started pumping oil in 1932, becoming the first among its Arab Gulf neighbours to produce oil.

The new finds have the potential to significantly raise the country’s profile and boost its economy, which has suffered double blows in recent years from lower oil prices and years of unrest and protests by some of the country’s Shia majority.

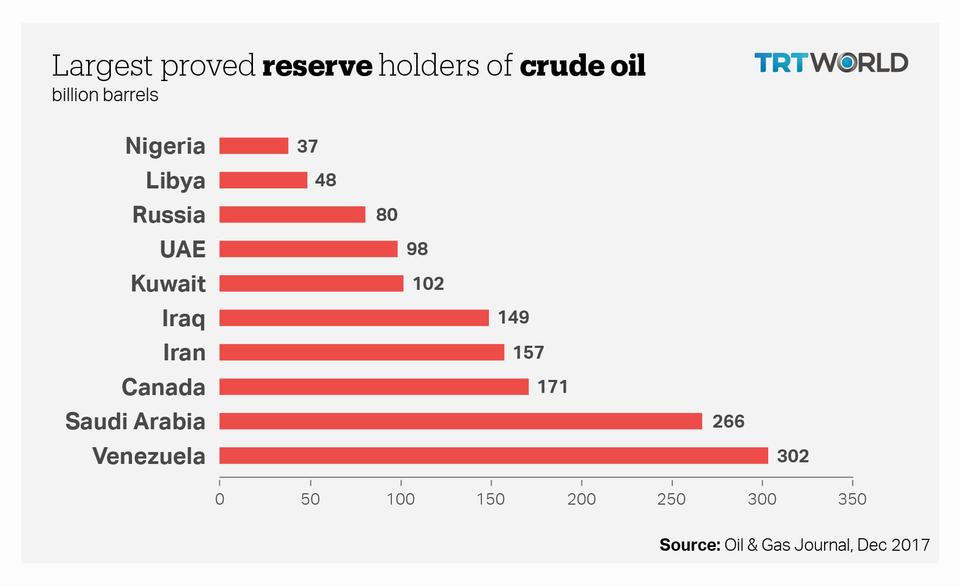

The oil minister of Bahrain, Sheikh Mohammed bin Khalifa al Khalifa on April 4, announced in a press conference the discovery of the kingdom’s largest oil and gas resources with an estimate to contain at least 80 billion barrels of tight oil/shale oil.

Tight oil is a form of light crude oil held in shale deep below the earth’s surface that is extracted with hydraulic fracturing, or fracking, using deep horizontal wells.

Independent appraisals by US-based oil consultants DeGolyer and MacNaughton and oilfield services company Halliburton confirmed Bahrain’s find of “highly significant quantities of oil in place … with tight oil amounting to at least 80 billion barrels, and deep gas reserves in the region of 10-20 trillion cubic feet,” Oil Minister Sheikh Mohammed bin Khalifa al Khalifa said.

Bahrain’s oil minister and energy executives detailed the find at a press conference, saying the tight oil was discovered in the offshore Khalij al Bahrain Basin, which spans some 2,000 square kilometres (770 square miles) in shallow waters off the country’s western coast.

The Gulf is a major trade route for oil tankers, its waters shared by Sunni Muslim Arab states and their historical rival Shia Iran.

Bahrain, which sits between regional arch-rivals Saudi Arabia and Iran, was the first of the Gulf states to discover crude but is today the smallest of the Gulf producers. It is ruled by a Sunni dynasty, which is supported by the Saudis.

Iran and Saudi Arabia support opposite sides in conflicts in Syria, Iraq and Yemen. Bahrain is a close ally of Britain, the United States and Saudi Arabia.

Saudi Arabia, the United Arab Emirates, Bahrain and Egypt cut off travel and trade ties with Qatar last June, accusing it of backing their arch-rival Iran and supporting terrorism. Qatar has denied the charges and has said the boycott was an attempt to impinge on its sovereignty and rein in its support for reform. Qatar and Iran share a massive offshore natural gas field in the Gulf.

Jointly shared offshore with Saudi Arabia

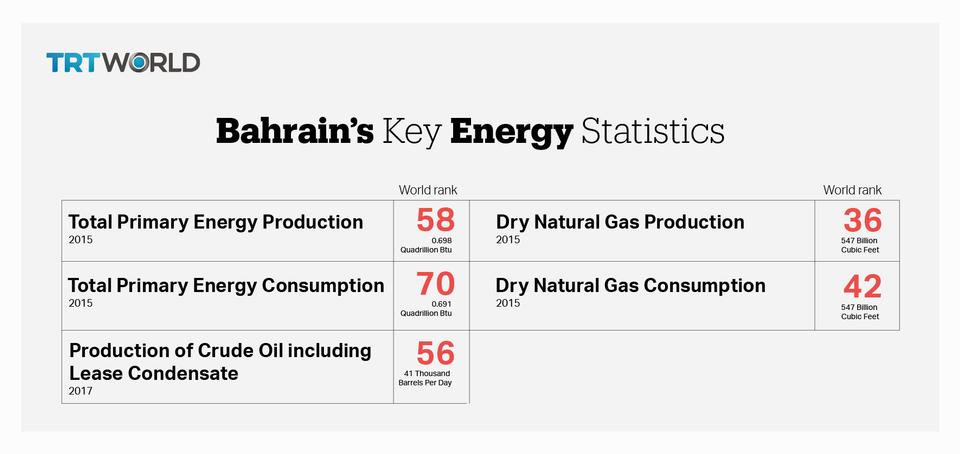

The small non-OPEC Gulf oil producer, with around 124.6 million barrels of proven reserves, gets its oil revenues from two fields: the onshore Bahrain field, discovered in 1932 and the offshore Abu Safah field, which is shared jointly with Saudi Arabia.

The new field would, in theory, dwarf the Bahrain field, the country’s only other oil field, which contains several hundred million barrels. The Bahrain field produced around 50,000 barrels per day (bpd) in 2015, according to the US Energy Information Administration.

Bahrain and Saudi Arabia split annual revenues from the 300,000 bpd Abu Safah offshore field, where production is overseen by Saudi Aramco. Thus, Manama also gets another 150,000 barrels daily from the Abu Safah offshore field.

The Bahraini government earned $4.3 billion in oil and gas revenue last year and ran a budget deficit of $2.7 billion.

‘Game changer’ potential

Officials did not give a specific figure on April 4, for expected production levels from the new field, but the Manama-based daily Al Ayam quoted the head of the financial and economic committee in the parliament, Abdulrahman Bu Ali, as saying output was expected to be 200,000 barrels per day.

The actual impact of the discovery is contingent on how much of it is actually extractable while Oil Minister Sheikh Mohammed bin Khalifa al Khalifa said the amount of oil that can be extracted from the Khalij al Bahrain Basin is still being studied.

Sheikh Mohammed said he was not sure yet how much of the estimated 80 billion barrels was recoverable, but the kingdom aims to attract foreign oil and gas firms to develop the resources.

Sadad al Husseini, a former senior executive at Saudi Aramco and now an energy consultant, said the discovery was positive news for Bahrain, but more data gathering, evaluation and well testing needed to follow to determine whether there are any future commercial opportunities in the resources.

“Converting resource estimates to reserves is an intense and costly process and not all the resources may ultimately be upgraded to reserves,” he said.

“The additional drilling and data gathering will serve to improve the accuracy and reliability of the estimate.”

Yahya al Ansari, exploration manager at Bahrain’s national oil company Bapco, said the pumping of oil from the field is not expected for at least five years.

Speaking to reporters after the press conference on April 4, Ansari said Bahraini authorities, in cooperation with international oil companies, were trying to establish how much oil can be extracted.

“What we have announced is oil in place … So far, we don’t know how much of it can be extracted and the cost of its production,” two important elements that could determine whether the major announcement is viable.

“The US shale oil industry normally extracts 5-10 percent of the known shale oil reserves and raising this percentage depends on the advancement of technology,” Ansari said.

The Bahraini minister and Ansari refused to be drawn into providing details about how much production Bahrain is likely to have in five years.

Analyst Stephen Brennock of broker PVM Oil said the find has “the potential to be a game changer” for the tiny Gulf kingdom.

“However, it is still early days and the reserves of the field have yet to be finalised. Moreover, it will be several years before these newly found supplies are brought online,” Brennock told AFP.

JBC Energy, an independent research centre, was equally cautious.

“It remains completely unclear yet how much of the 80 billion barrels can be seen as recoverable reserves. Furthermore, apparently it is a shale oil reservoir, which would inflate production costs.

“Nonetheless it is a significant discovery and even if only a small fraction of it can be produced it would change Bahrain’s position in the region substantially,” a JBC analyst said.

Involvement of international consultants

International consultants DeGolyer and MacNaughton, Halliburton, and Schlumberger are heading the project with Bahrain’s National Oil and Gas Authority.

“Agreement has been reached with Halliburton to commence drilling on two further appraisal wells in 2018, to further evaluate reservoir potential, optimise completions, and initiate long-term production,” Sheikh Mohammed told the news conference in the capital Manama.

“The newly discovered resource, which officials expect to be ‘on production’ within five years, is expected to provide significant and long-term positive benefits to the kingdom’s economy – both directly and indirectly through downstream activities in related industries,” Bahrain’s National Communication Centre said in a statement.

Shale oil production is a costly business and is far more expensive than conventional oil. In some cases, high cost makes production commercially not possible.

US and UK navy in Bahrain

Meanwhile, Britain has opened its first permanent military base in the Middle East in more than four decades on April 5, in Bahrain, giving the European country an expansive presence along key international shipping routes.

The UK Naval Support Facility can house up to around 500 Royal Navy personnel, including sailors, soldiers and airmen, in a region where maritime security ensures oil shipments and goods make it from Asia to Europe. British officials have described it as the first permanent British base east of the Suez Canal since 1971.

“The aim of the Royal Navy being out here anyway is to enhance and ensure the maritime security in the region, and whether or not that’s law and order on the high seas, countering piracy, countering terrorism, making sure that the high seas are all safe for the free-flow of commerce, the free flow of trade to be able to take place,” said Commodore Steve Dainton, UK Maritime Component Commander.

The new British hub makes it easier for the Royal Navy to conduct longer-term deployments in the Persian Gulf and will offer engineering and logistical support for ships.

Bahrain also hosts the US Navy’s 5th Fleet.

Tense encounters have occurred between the US and Iranian naval forces in the Persian Gulf, though the US military officials say, “Iranian naval forces appear to have deliberately halted their provocations of US navy ships in recent months.”

Grievances after 2011 unrest

Bahrain, led by a Sunni monarchy, was rocked by protests in 2011 by its Shia majority and others aimed at demanding more political freedoms from the ruling Al Khalifa family. The government put down the demonstrations with help from Saudi and Emirati troops.

The ongoing crackdown has seen dozens of activists imprisoned, others exiled, and a major Shia opposition group dismantled.

Bahrain, which is rated junk by all three major credit rating agencies, revealed the oil discovery just a few days after yields on its international bonds spiked as investors became more concerned about its rising public debt levels.

The country has introduced some austerity measures to limit spending and boost revenue, including reducing some fuel subsidies and increasing taxes. To help cope with the drop in oil revenues following the collapse in crude prices, slashed by half since mid-2014, the GCC states decided to impose a value-added tax of five percent from 2018.

Bahrain, which is not a member of the Organization of Petroleum Exporting Countries (OPEC), is nonetheless part of an agreement between OPEC and non-OPEC members to cut oil production in the wake of the 2014 market crash.

The Gulf Cooperation Council, which groups Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates, together pump around 17 million barrels of oil per day, equivalent to some 18 percent of global production or 55 percent of OPEC’s output.