-

Oman securities rally on plan to cut borrowing requirements

- Plan to offer only ‘temporary reprieve’ to curve: ENBD Asset

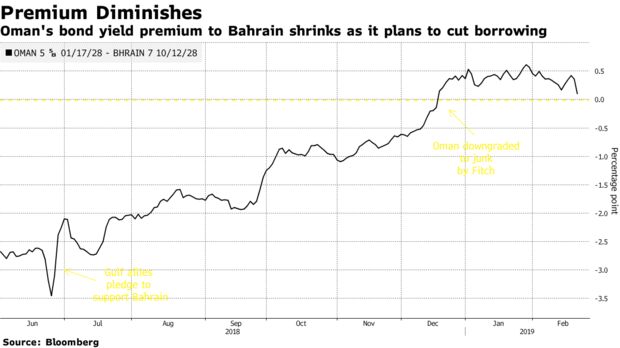

The hefty premium investors demanded to hold Oman’s Eurobonds rather than those of lower-rated Bahrain is shrinking.

The sultanate’s plans to slash its borrowing requirements and rely on asset sales for funding lifted Eurobonds due 2028 by the most on record, driving the yield down as much as 51 basis points to 6.30 percent. That briefly wiped out its premium to Bahrain’s similar-maturity debt, which rallied last year after winning a $10 billion bailout package and inclusion in JPMorgan Chase & Co.’s emerging-market bond indexes.

Oman’s bonds yielded 11 basis points more than Bahrain’s at 12:04 p.m. in London, compared with about 60 basis points in January, according to data compiled by Bloomberg. The sultanate’s BB grade by S&P Global Ratings is two levels higher than Bahrain’s.

Oman, which has one of the largest budget deficits among oil exporters, will also tap a $1.2 billion loan backed by the World Bank’s Multilateral Investment Guarantee Agency, and any additional funding will come through domestic borrowing, a senior government official said on condition of anonymity because the plans haven’t been made public.

“A higher reliance on alternative sources, including the World Bank’s MIGA loan, and consequently lower Eurobond issuance in the first half, addresses Oman’s funding needs in the short-term,” said Angad Rajpal, the head of fixed income at Emirates NBD Asset Management in Dubai. “While this should offer a temporary reprieve to Oman’s outstanding curve, which trades significantly wider than its peers, it still doesn’t address structural concerns regarding Oman’s weak fiscal and external dynamics.”

Oman has been slow to implement reforms following the crash in oil prices in 2014. Since then, its debt as a share of economic output has risen 10-fold to 50 percent. Fitch Ratings downgraded the country’s debt to junk in December, fueling a sell-off in the nation’s bonds.

“Unless Oman commits to a credible fiscal consolidation program, fiscal slippage is inevitable and could bring the issuer back to the market later in the year,” Rajpal said.