Originally posted on the Economist, Apr 30th 2016.

Bold promises from a young prince. But they will be hard to keep.

IF ANYONE needed confirmation that Muhammad bin Salman, Saudi Arabia’s deputy crown prince, is a man in a hurry, they got it on April 25th. The 30-year-old unveiled a string of commitments to end the kingdom’s dependence on oil by 2030 which, in themselves, would be a remarkable achievement for a hidebound country. Then he proceeded to trump himself, saying that the kingdom could overcome “any dependence on oil” within a mere four years, by 2020.

That may have been meant to convey a sense of urgency; but it also sums up what seems to be manic optimism among the youthful new policy-setters of the royal court. They have yet to set out a cool, detailed explanation of how to turn vision into reality. That has been promised since January, and will now supposedly be provided in a few weeks’ time.

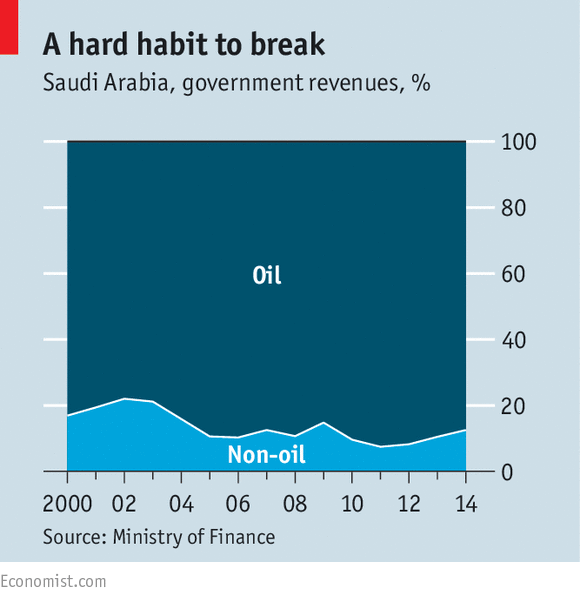

The outlines of the announcement, which has generated much anticipation, had been well trailed. They included: the floating of a small stake in Saudi Aramco, the world’s biggest oil company; the creation of the world’s largest sovereign-wealth fund to invest in a diverse range of assets; more jobs for women; and more vibrant non-oil industries, ranging from mining to military hardware. These are radical proposals in a country that has historically generated nine-tenths of government revenues from oil, and whose budget deficit is expected to reach 13.5% of GDP this year after an 18-month slump in oil prices.

Prince Muhammad backtracked on none of them this week—though his modest goal of raising the female participation rate in the workforce from 22% to only 30% in 15 years appeared to reflect resistance from the Wahhabi religious establishment, whose shadow hangs over all reform in Saudi Arabia. A promise that women would be allowed to drive, essential if they are to enter the workforce fully, had been hoped for by some, but failed to materialise. There was also no word on democratic reform or other freedoms: the sort of things which might be expected to appeal to a youthful population.

The prince expects the sale of a stake of up to 5% in Aramco to value the company at a minimum of $2 trillion, and he promised to transform it into a “global industrial conglomerate” (see article). Much remains unclear. But the proceeds of the sale, and the business itself, would be put into a sovereign wealth fund known as the Public Investment Fund, which with other assets could be worth as much as $3 trillion, generating plenty of non-oil investment income. Other industries would be given incentives to grow. The kingdom, with the world’s third-biggest military budget, spends only 2% of it on arms purchases at home. The “vision” calls for over half of it to be spent on locally made armaments by 2030.

To achieve such goals, Saudi Arabia needs to throw itself open to trade, investment, foreign visitors and international codes of conduct such as more transparency and secular laws. But much of this is anathema to the clerics who, for decades, have sought to shun the outside world. Powerful business interests within the prince’s own huge extended family will also slow things down. The tense feud with Iran, stoked by Prince Muhammad through a proxy war in neighbouring Yemen, adds potential instability to the risks that investors would face. But a step in the right direction was unveiled this week with the promise of “green cards”, permanent-residence documents for foreigners.

The indolence of a society brought up to expect that oil riches will be lavished upon them is another large hurdle. For years, efforts to end the kingdom’s addiction to oil have run up against a wall of apathy. As one Saudi commentator puts it, “It’s been like a father telling his 40-year-old son that it’s time to go out and get a job.” Prince Muhammad’s youth in a country used to gerontocratic rulers should make it easier for him to motivate young people, and social media give him better access to the pulse of the country. But with oil revenues weak and unemployment at 11.6%, the chances of disillusion are strong.

That is why he will have to address some of the questions hanging over the reforms when he reveals the National Transformation Plan, fleshing out his vision, in late May or early June. Foreign executives in Riyadh, impressed by the urgency with which Prince Muhammad’s economic council appears to be slashing government waste, say concrete steps are needed before investment will come in.

“The big change here is that they’ve recognised ‘We’re inefficient, we’re corrupt and we need to change,’” says Paddy Padmanathan, chief executive of Acwa Power, a Saudi electricity-generator which hopes to benefit from a pledge to produce 9,500 megawatts of renewable energy. He lauds the cutting of subsidies for public services such as electricity. But he adds that to attract investment the government will need to clarify the privatisation plans for its utilities, and show how they can balance their books. Investors “don’t want to rely on a macho government saying ‘Trust me, I will pay,’” he says. Another businessman says the country needs labour-market reform so that it becomes politically possible to fire Saudi employees who fail to do their jobs. “If you fired 20 Saudis who didn’t turn up for work, you’d find yourself in a Twitter storm,” he says.

Ultimately, the chances for success may depend on the power of the prince himself, who has amassed enormous control over policymaking since his 80-year-old father, Salman, became king last year. But he remains only second in line to the throne, and has a stalemate in Yemen counting against him. “This is not a dream, this is a reality that will be achieved, God willing,” he says. But when the sums involved are in the trillions of dollars, the neighbourhood is fraught with tension and the reforms require the tearing up of a social contract to succeed, the burden of proof is high. Saudi Arabia has promised diversification away from oil for decades. The prince still needs to prove that this time is any different.

Link to original post:

https://www.economist.com/middle-east-and-africa/2016/04/30/saudi-arabias-post-oil-future